Making money from Americans who don't understand British politics, again and again and again...

We love a cash‐rich, credulous Yank at The Jolly Trader!

In January, Elon Musk started tweeting about the British grooming gangs story. Then the American media picked up his tweets, and for many Americans, it was the first they’d heard of it. Cue a rather incredible money‐making opportunity on Polymarket.

On January 16th, Americans with little understanding of British politics drove the price of a market on a Starmer pre‐July exit to 18%! And note the insane trading volume, too—this wasn’t a small market; there was serious profit to be made.

You had two weeks to take advantage of this madness. For two whole weeks the price was between 10–18% before it slumped. Then it rebounded to the 10–13% range for about a month. Gotta love cash‐rich Americans.

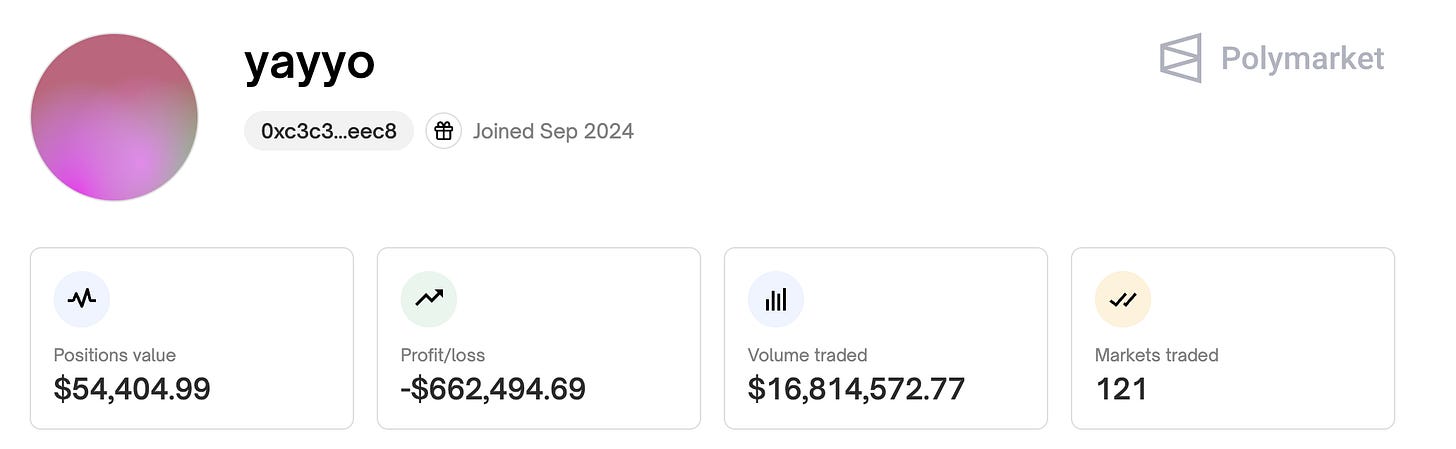

Here’s the top “Yes” trader, by the way. They’ve lost over $600,000 just on Polymarket.

Most of the “Yes” traders are serial losers. The top five “No” traders, in contrast, have over $800,000 in collective profit.

Unfortunately, the market is now trading around 6%, which is only a bit above Treasury bonds—makes sense, because there’s always the small possibility Starmer could die.

But don’t worry if you missed this one. I’ve got you covered with the free trade of the week!

Free Trade Of The Week: Starmer out in 2025

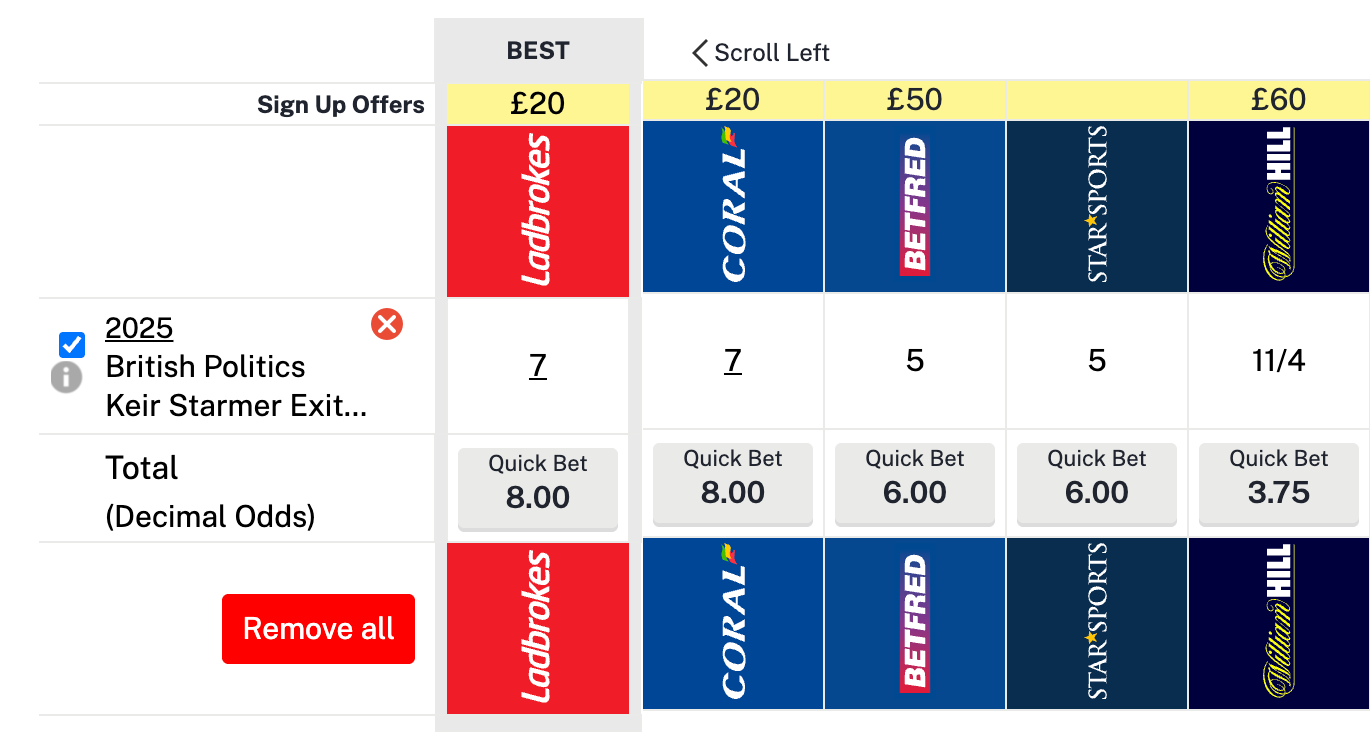

You can see the current Polymarket price above for Starmer’s 2025 exit. At the time of writing it’s 19%.

Unfortunately, liquidity in this market is lower, but there’s still plenty of meat on the bone—especially for readers who get in early. The "Yes" price has even spiked as high as 20% in recent days.

My personal estimate is around 8–10% that Starmer ceases to be Prime Minister during 2025. Keep in mind that we must factor in the slight possibility of him leaving office due to ill health, alongside the remote chance he might be forced out.

Anyway, I’d play this as an Expected Value Bet1.

My justification for an 8-10% chance is as follows.

Starmer out in 2025? 10% at most.

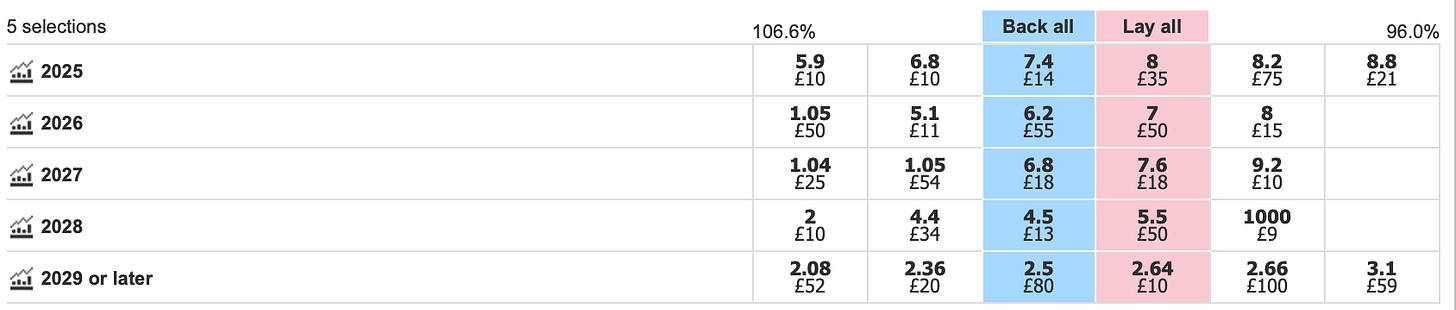

Betfair’s Exchange, which usually attracts more informed bettors than Polymarket on these matters (sorry again, Americans), is implying about a 12–14% chance of a 2025 exit—though admittedly with slightly lower liquidity.

Meanwhile, bookmakers offer odds ranging from 12.5% all the way up to a laughable 26.7% at William Hill.

By the way, if you don’t know specifically how bookmakers make money, you should read the footnote here before proceeding.2

The bookies average out to 17% for a Starmer 2025 exit. Politics tends to have higher margins because the odds aren’t as sharp. Less informed bettors + looser pricing = more profit.

Typically, the "true" probability is about 2–4 percentage points lower than the implied odds in these inefficient political markets. So, a bookmaker’s 17% translates to roughly 13–15% actual probability, giving them a built-in margin of around 15–20%.

13% is still way too high, though. Bookmakers are inherently conservative on political markets.

Also, the people who make these odds aren’t exactly brilliant minds. Because political betting is a relatively niche area (with less overall volume than mainstream sports), there often isn’t a full‐time “political trader” at many bookies. Instead, it’s typically one of the existing traders (often someone with an interest or background in politics and polling) who is assigned to price the political specials. In that sense, the compensation is usually in line with their general trading role rather than being a separate pay scale. At most they’re getting £100k, most are probably on half that. So take their predictive powers with a kilo of salt.

Only two post-war PMs left office within 18 months: Sir Alec Douglas-Home (lost an election) and Liz Truss (lost her mind). Both were Conservatives. In fact, the ten shortest-serving UK Prime Ministers have all been Conservatives. The only Labour PM who didn’t make it past two years was Clement Attlee, and that was during his second term. Starmer is a careerist who fought tooth and nail to reach the top; he's not stepping aside in 2025.

I’m keen to hear from people in the comments.

Plaaaace your bets!3

TJT

Note: This is a free article. They’re rare. And they’re not where I offer the best opportunities and insights. For that, you’ll need to become a paid subscriber.

Expected Value betting simply means placing bets when the odds you get are better than what you estimate the true probability of the event to be.

For example, if you estimate there's only an 8–10% chance Starmer leaves office in 2025, but you can place a bet at odds that imply a much higher chance—such as Polymarket’s current odds of 18%—then you're making a bet with positive expected value.

Think of it like flipping a biased coin that lands on heads just 10% of the time, but someone is willing to pay you as if it had an 18% chance. If you took that bet repeatedly, you’d reliably make money over the long run.

This doesn't mean every EV bet wins. Instead, it's about consistently betting when the odds are in your favour, trusting that in the long term, you'll come out ahead.

At The Jolly Trader, that's one of the main games we play: always hunting for odds that pay you more than the actual risk you're taking. You need two things to make a lot of money from these bets: (a) capital (b) high liquidity markets.

Bookmakers make money by offering odds that imply a greater than 100% probability across all outcomes — this is called the overround. They try to get equal money on both sides of a bet, so they just pay out the winners using the losers’ money, keeping the margin as profit.